This challenge is one I see a lot while providing management consulting, mentoring and coaching to entrepreneurs and startup teams.

For example, a business plans to offer the following products and services:

- web design

- web site maintenance

- web design instruction

- instructional packages for website owners

- life coaching

- photography

- public speaking

- writing

- professional skating instruction

You can make the case that 1-4 are related products and could be complementary offerings.

You can also make a case that public speaking and writing can address any of the other offerings.

However, you cannot make a case that attempting to sell all of these diverse products and services is possible in a brand coherent, much less an energy and capital efficient, manner.

I have personally been a professional photographer, public speaker and writer. I know, first-hand, how much time, energy and marketing focus is required to be a success in any one of those three endeavors.

And that is really the point here. It is tough enough to build a successful business around any one, single offering, much less nine, and especially nine that are either completely disparate or tenuously related.

Each offering you sell has its own set of development, maintenance, delivery and support requirements. Each offering has its own market and customers, each requiring very specific value propositions, brand positionings, marketing messages, sales channels and execution.

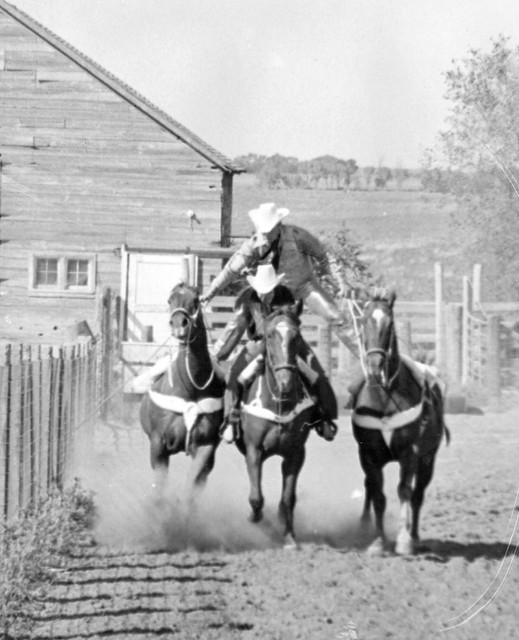

Each business is a bucking bronco in its own right.

Trying to ride multiple horses at once is tough enough as a rodeo trick.

It is not a valid business model.

You need to pick a horse and ride it.

Pick one horse, one market, one set of customers, one value proposition, one brand position, one marketing message, one sales channel and one business model to execute.

Find a market niche and own that niche. Then expand from there.

Nine horses is too many to ride.

Before you build a business plan, pick a horse and ride it.

* * * * * * *